Full list: Trump’s tariffs on every country, including the UAE, Saudi

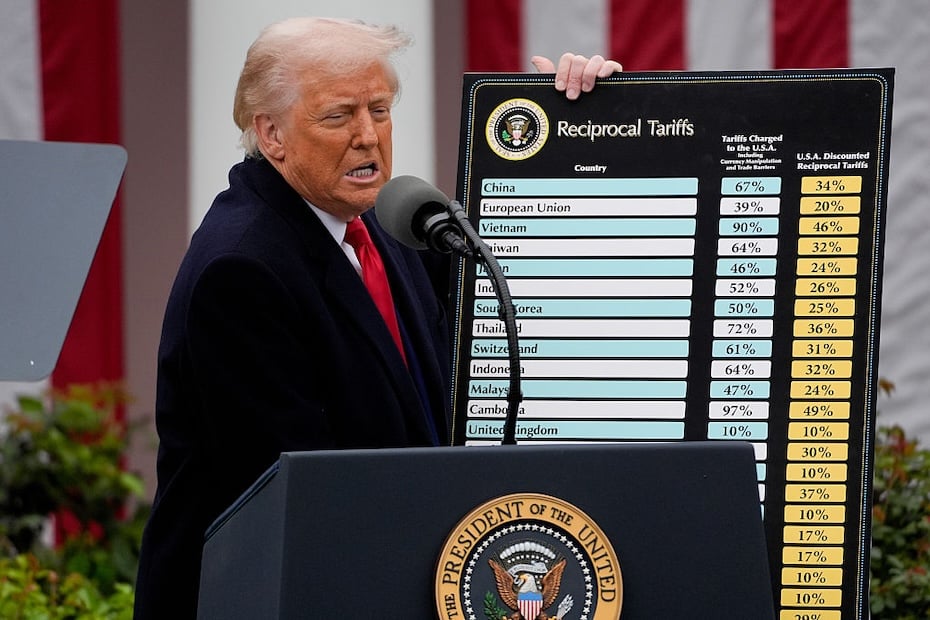

The tariff regime, described by Trump as a “universal baseline tariff”, aims to set a flat 10 per cent import tax on all goods entering the US

US President Donald Trump has unveiled sweeping new tariff plans as part of what he calls ‘Liberation Day’ — and no country is spared.

Read more: Trump tariffs jolt Tokyo: Stocks on track for worst week in 5 years

The tariff regime, described by Trump as a “universal baseline tariff,” aims to set a flat 10 per cent import tax on all goods entering the US. However, this is just one part of a broader strategy: every country in the world would also face reciprocal tariffs from the US based on how they currently tax American goods.

Trump’s “America First” trade policy will see tariffs spike for countries such as Lesotho, with reciprocal tariffs from the US reaching as high as 50 per cent.

Interestingly, the White House has confirmed that Canadian and Mexican goods compliant with the US-Mexico-Canada Agreement (USMCA) will remain tariff-free. While new reciprocal tariffs won’t apply to Mexico and Canada, existing tariffs related to fentanyl will stay in place. USMCA-compliant goods will continue to face a 0 per cent tariff, while non-compliant goods will incur a 25 per cent tariff, and non-compliant energy and potash will face a 10 per cent tariff.

Amid this backdrop, Gulf countries such as the UAE and Saudi Arabia remain relatively unscathed in comparison, with both facing a 10 per cent reciprocal US tariff.

“Despite the US maintaining a trade surplus with all six GCC countries in 2024, Trump imposed a 10 per cent baseline import tariff on these nations, aligning with the tariffs they apply on US goods,” said Vijay Valecha, CIO at Century Financial.

“Last year, the US exported goods worth $27bn to the UAE, significantly exceeding the $7.5bn in imports from the UAE. This resulted in a $19.5bn surplus for the US, reflecting a 6.9 per cent increase from 2023. Additionally, the Value Added Tax (VAT) in GCC countries remains relatively low compared to the higher tax rates across Europe. Most GCC nations impose a 5 per cent VAT, with Saudi Arabia applying a higher rate of 15 per cent,” Valecha added.

Meanwhile, Hamza Dweik, head of trading and pricing (MENA) at Saxo Bank MENA, told Gulf Business that the new tariffs could even present an economic opportunity for the GCC.

“The GCC nations may need to explore new markets and strengthen trade ties with regions unaffected by these tariffs. Diversifying their economic base beyond oil exports will be crucial in mitigating the risks associated with external economic shocks,” said Dweik.

“While the tariffs present challenges, they also offer an opportunity for the GCC nations to accelerate their economic diversification efforts and strengthen regional trade partnerships. By proactively addressing these challenges, the GCC can continue to thrive in an evolving global trade landscape,” he added.

The full list, published below, details a country-by-country breakdown of the tariffs and the reciprocal rates:

Full list of Trump’s tariffs

| Country/Region | Country/Region Tariff* | US Reciprocal Tariffs |

|---|---|---|

| Afghanistan | 49% | 10% |

| Albania | 10% | 10% |

| Algeria | 59% | 30% |

| Andorra | 10% | 10% |

| Angola | 63% | 32% |

| Anguilla | 10% | 10% |

| Antigua and Barbuda | 10% | 10% |

| Argentina | 10% | 10% |

| Armenia | 10% | 10% |

| Aruba | 10% | 10% |

| Australia | 10% | 10% |

| Azerbaijan | 10% | 10% |

| Bahamas | 10% | 10% |

| Bahrain | 10% | 10% |

| Bangladesh | 74% | 37% |

| Barbados | 10% | 10% |

| Belize | 10% | 10% |

| Benin | 10% | 10% |

| Bermuda | 10% | 10% |

| Bhutan | 10% | 10% |

| Bolivia | 20% | 10% |

| Bosnia and Herzegovina | 70% | 35% |

| Botswana | 74% | 37% |

| Brazil | 10% | 10% |

| British Indian Ocean Territory | 10% | 10% |

| British Virgin Islands | 10% | 10% |

| Brunei | 47% | 24% |

| Burma | 88% | 44% |

| Burundi | 10% | 10% |

| Cabo Verde | 10% | 10% |

| Cambodia | 97% | 49% |

| Cameroon | 22% | 11% |

| Cayman Islands | 10% | 10% |

| Central African Republic | 10% | 10% |

| Chad | 26% | 13% |

| Chile | 10% | 10% |

| China | 67% | 34% |

| Christmas Island | 10% | 10% |

| Cocos (Keeling) Islands | 10% | 10% |

| Colombia | 10% | 10% |

| Comoros | 10% | 10% |

| Congo (Brazzaville) | 10% | 10% |

| Congo (Kinshasa) | 22% | 11% |

| Cook Islands | 10% | 10% |

| Costa Rica | 17% | 10% |

| Cote d’Ivoire | 41% | 21% |

| Curacao | 10% | 10% |

| Djibouti | 10% | 10% |

| Dominica | 10% | 10% |

| Dominican Republic | 10% | 10% |

| Ecuador | 12% | 10% |

| Egypt | 10% | 10% |

| El Salvador | 10% | 10% |

| Equatorial Guinea | 25% | 13% |

| Eritrea | 10% | 10% |

| Eswatini | 10% | 10% |

| Ethiopia | 10% | 10% |

| EU | 39% | 20% |

| Falkland Islands (Islas Malvinas) | 82% | 41% |

| Fiji | 63% | 32% |

| French Guiana | 10% | 10% |

| French Polynesia | 10% | 10% |

| Gabon | 10% | 10% |

| Gambia | 10% | 10% |

| Georgia | 10% | 10% |

| Ghana | 17% | 10% |

| Gibraltar | 10% | 10% |

| Grenada | 10% | 10% |

| Guadeloupe | 10% | 10% |

| Guatemala | 10% | 10% |

| Guinea | 10% | 10% |

| Guinea-Bissau | 10% | 10% |

| Guyana | 76% | 38% |

| Haiti | 10% | 10% |

| Heard and McDonald Islands | 10% | 10% |

| Honduras | 10% | 10% |

| Iceland | 10% | 10% |

| India | 52% | 26% |

| Indonesia | 64% | 32% |

| Iran | 10% | 10% |

| Iraq | 78% | 39% |

| Israel | 33% | 17% |

| Jamaica | 10% | 10% |

| Japan | 46% | 24% |

| Jordan | 40% | 20% |

| Kazakhstan | 54% | 27% |

| Kenya | 10% | 10% |

| Kiribati | 10% | 10% |

| Kosovo | 10% | 10% |

| Kuwait | 10% | 10% |

| Kyrgyzstan | 10% | 10% |

| Laos | 95% | 48% |

| Lebanon | 10% | 10% |

| Lesotho | 99% | 50% |

| Liberia | 10% | 10% |

| Libya | 61% | 31% |

| Liechtenstein | 73% | 37% |

| Madagascar | 93% | 47% |

| Malawi | 34% | 17% |

| Malaysia | 47% | 24% |

| Maldives | 10% | 10% |

| Mali | 10% | 10% |

| Marshall Islands | 10% | 10% |

| Martinique | 10% | 10% |

| Mauritania | 10% | 10% |

| Mauritius | 80% | 40% |

| Mayotte | 10% | 10% |

| Micronesia | 10% | 10% |

| Moldova | 61% | 31% |

| Monaco | 10% | 10% |

| Mongolia | 10% | 10% |

| Montenegro | 10% | 10% |

| Montserrat | 10% | 10% |

| Morocco | 10% | 10% |

| Mozambique | 31% | 16% |

| Namibia | 42% | 21% |

| Nauru | 59% | 30% |

| Nepal | 10% | 10% |

| New Zealand | 20% | 10% |

| Nicaragua | 36% | 18% |

| Niger | 10% | 10% |

| Nigeria | 27% | 14% |

| Norfolk Island | 58% | 29% |

| North Macedonia | 65% | 33% |

| Norway | 30% | 15% |

| Oman | 10% | 10% |

| Pakistan | 58% | 29% |

| Panama | 10% | 10% |

| Papua New Guinea | 15% | 10% |

| Paraguay | 10% | 10% |

| Peru | 10% | 10% |

| Philippines | 34% | 17% |

| Qatar | 10% | 10% |

| Reunion | 73% | 37% |

| Rwanda | 10% | 10% |

| Saint Elena | 15% | 10% |

| Saint Kitts and Nevis | 10% | 10% |

| Saint Lucia | 10% | 10% |

| Saint Pierre and Miquelon | 99% | 50% |

| Saint Vincent and the Grenadines | 10% | 10% |

| Samoa | 10% | 10% |

| San Marino | 10% | 10% |

| São Tomé and Príncipe | 10% | 10% |

| Saudi Arabia | 10% | 10% |

| Senegal | 10% | 10% |

| Serbia | 74% | 37% |

| Sierra Leone | 10% | 10% |

| Singapore | 10% | 10% |

| Sint Maarten | 10% | 10% |

| Solomon Islands | 10% | 10% |

| South Africa | 60% | 30% |

| South Korea | 50% | 25% |

| South Sudan | 10% | 10% |

| Sri Lanka | 88% | 44% |

| Sudan | 10% | 10% |

| Suriname | 10% | 10% |

| Svalbard and Jan Mayen | 10% | 10% |

| Switzerland | 61% | 31% |

| Syria | 81% | 41% |

| Taiwan | 64% | 32% |

| Tajikistan | 10% | 10% |

| Tanzania | 10% | 10% |

| Thailand | 72% | 36% |

| Timor-Leste | 10% | 10% |

| Togo | 10% | 10% |

| Tokelau | 10% | 10% |

| Tonga | 10% | 10% |

| Trinidad and Tobago | 12% | 10% |

| Tunisia | 55% | 28% |

| Turkey | 10% | 10% |

| Turkmenistan | 10% | 10% |

| Turks and Caicos Islands | 10% | 10% |

| Tuvalu | 10% | 10% |

| Uganda | 20% | 10% |

| Ukraine | 10% | 10% |

| United Arab Emirates | 10% | 10% |

| United Kingdom | 10% | 10% |

| Uruguay | 10% | 10% |

| Uzbekistan | 10% | 10% |

| Vanuatu | 44% | 22% |

| Venezuela | 29% | 15% |

| Vietnam | 90% | 46% |

| Yemen | 10% | 10% |

| Zambia | 33% | 17% |

| Zimbabwe | 35% | 18% |

*Including currency manipulation and trade barriers, according to White House. Source: White House