Data Center Market in India - Industry Analysis, Market Share, Size, Top Trends, Market Research Report 2024

Adoption of converged and hyper-converged infrastructure will add more revenues to the India data center market

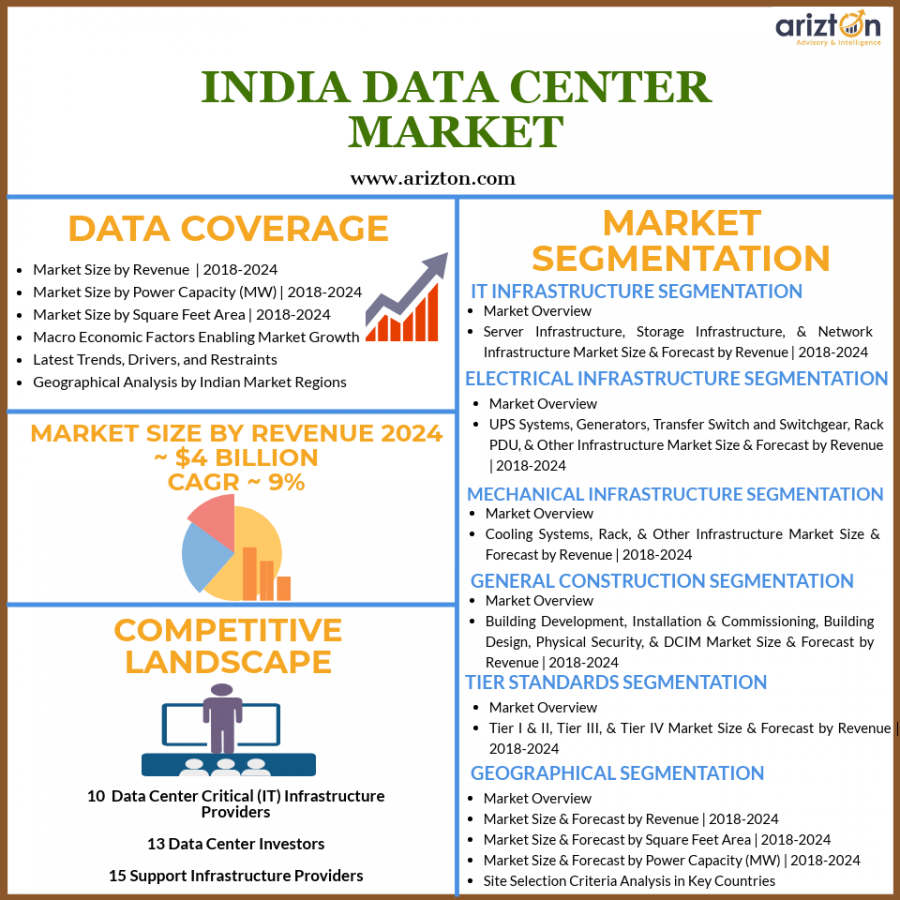

CHICAGO, IL, UNITED STATES, January 22, 2019 /EINPresswire.com/ -- The India data center market is expected to reach values of approximately $4 billion by 2024, growing at CAGR of around 9% during 2018-2024. The market research report also offers market share analysis in terms of power capacity (MW) and area (square feet).

Major cities such as Mumbai, Bangalore, and Hyderabad are witnessing high investments of local and international operators in the Indian market. The increasing construction of hyperscale facilities with the power capacity of over 50 MW will fuel the need for innovative infrastructure in the market over the next few years.The India data center market is driven by construction of hyperscale facilities in major cities such as Mumbai, Bangalore, and Hyderabad. The increasing use of high-performance infrastructure is leading to the growth of rack power density to an average of around 8-10 kW in the India data center market. The market research report provides in-depth market analysis and segmental analysis of the India data center market by electrical construction, mechanical construction, IT infrastructure, general construction, tier standards, and geography.

The study considers the present scenario of the India data center market and its market dynamics for the period 2018−2024. It covers a detailed overview of several market growth enablers, restraints, and trends. Also, the study profiles and analyzes leading and other prominent India data center market participants across infrastructure vendors, data center general construction contractors, and colocation providers operating in the Indian data center market.

Data Center Market in India – Dynamics

The adoption of cloud-based services is growing significantly worldwide. There is a growing demand for IaaS, SaaS, and PaaS among enterprise customers in India adopting public and private cloud services during the forecast period. In terms of current scenario, adoption of SaaS dominates the Indian market adding a revenue of around $850 million in 2018.Increase in internet population, use of smart devices, and social media growth as prompted both central and state government to migrate from the existing traditional service offerings to digital platforms. In 2018 budge, the central government has emphasized the importance of increasing cloud and data center investment in the Indian market. Back in 2011, multiple investment on data center was identified among state government across the country in multiple states through State Data Centre (SDC) guided by Ministry of Electronics and Information Technology. Government also started an initiative namely, MeghRaj to make sure that service providers hosting government-based cloud application should store the related data inside the country.The increase in demand for cloud computing, big data, and IoT services has been aiding the market growth. Storage systems that are used in modern data centers include, Storage Area Networking (SAN), Network Attached Storage (NAS), and Direct Attached Storage (DAS). It can also be classified into storage systems based on hard disk drives (HDD), Solid State Device (SSD), tape storage, object storage, and hybrid storage arrays.

Data Center Market in India – Segmentation

This market research report includes a detailed segmentation of the market by electrical construction, mechanical construction, IT infrastructure, general construction, tier standards, and geography. The India data center market by electric infrastructure is segmented into UPS systems, generators, transfer switches & switchgear, Rack PDU, and other electrical infrastructure. UPS systems dominated the largest India market share in 2018, growing at a CAGR of more than 13% during the forecast period. The installation of large UPS systems that are capable of supplying MW power is kept in a centralized location to provide backup power for the entire facility during an outage in the India market.In the Indian market, diesel generators dominate over 95% of the market, where the use of gas generators is very low. The increasing construction of large facilities will lead to the adoption of medium- and high-voltage switchgear in the market over the next few years. The construction of large data centers will lead to the adoption of rack PDUs with the capacity of over 10 kW in the India data center market after 2020.

The IT infrastructure segment in the India data center market is classified into server, storage, and network. The network infrastructure is the fastest growing segment in the Indian market, at a CAGR of more than 10% during the forecast period. The increase in the adoption of a variety of configuration, with one ethernet switch comprising multiple ports (10/40/25/50/100) in a single switch, is fueling the growth of this segment.The rising adoption of all-flash and hybrid storage arrays is driving the growth of the market. The installation of the server infrastructure that offers seamless integration of form factors, energy consumption, and virtualization technologies is fueling the growth of the India data center market.The India data center market by mechanical infrastructure is categorized into cooling systems, racks, and other infrastructure. Data center cooling systems segment occupied the majority of the market share in 2018, growing at a CAGR of over 14% during the forecast period. Most of the facilities in India are powered by air-based cooling systems. However, it is expected the use of water-based cooling will increase in the market during the forecast period.

The vendors are constantly innovating in the rack segment with designs that provides up to 80% airflow perforation, enhanced cabling channels, and support more weight capacity in the market. The implementation of other infrastructure with the redundancy of N+N configuration will lead to the development of the India data center market.The general construction segment in the India data center market is divided into building development, installation and commissioning services, building design, physical security, and DCIM. DCIM is the fastest growing segment in the India market, at a CAGR of around 21% during the forecast period. The increasing use of DCIM solution to control power consumption, improve efficiency, and increase operational capabilities is fueling the adoption of these systems in the Indian market.The large-scale data center deployment is likely to involve the installation of on-site renewable power sources such as solar energy to partially or entirely power operations in the India market. The implementation of security systems that comprise of sensors which are integrated with the existing DCIM solutions for real-time remote monitoring benefits will transform the India data center market.

The India data center market by tier standard is classified into Tier I & II, Tier III, and Tier IV. Tier III segment dominated the largest market share in 2018, growing at a CAGR of approximately 14% during the forecast period. Majority of the new facilities in India are designed of Tier III standards with a minimum of N+1 redundancy and can be reconfigured with up to 2N redundancy as the demand arises.The increasing investments from global cloud providers and leading colocation providers are fueling the need for facilities of Tier IV standard in the market. Companies such as CtrlS, GPX Global Systems, and Pi Datacenters are investing in the development of facilities of Tier IV category in the India data center market.

Market Segmentation by IT Infrastructure

• Server

• Storage

• Network

Market Segmentation by Electrical Infrastructure

• UPS systems

• Generators

• Transfer Switch and Switchgear

• Rack PDU

• Other Infrastructure

Market Segmentation by Mechanical Infrastructure

• Cooling Systems

• Rack

• Other Infrastructure

Market Segmentation by General Construction

• Building Development

• Installation & Commissioning

• Building Design

• Physical Security

• DCIM

Market Segmentation by Tier Standard

• Tier I and Tier II

• Tier III

• Tier IV

Looking for more information? Order a report.

Data Center Market in India – Geography

The geographical segment in the India data center market is divided into Maharashtra, Karnataka, Telangana, and other states. Telangana is one of the leading cities in the Indian market, growing at the fastest CAGR of around 19% during the forecast period. The increasing initiatives by the state government in Telangana and Andhra Pradesh supporting facility service providers that are investing in data centers across the state is contributing to the growth of this region. Hyderabad is the major city for datacenter operations in Telangana and has a presence of over 10 facilities in the Indian market.Maharashtra, specifically Mumbai is the hub for facilities deployment by major companies such as AWS, Microsoft, Alibaba, and Google in the Indian market. NTT Netmagic (DC3 Bangalore), ITI Limited, CtrlS, and ST Telemedia GDC are among the major investors across Karnataka in the India data center market.

Market Segmentation by Geography

• Maharashtra

• Karnataka

• Telangana

• Other States

Key Vendor Analysis

The India data center market has multiple numbers of players participating in the competition across the country. The steady development regarding IT infrastructure procurement, Greenfield, brownfield, and modular facility is creating lucrative opportunities for the leading players in the market. Various companies are investing in multiple innovations that enable flexible and scalable enterprise operations in the era of cloud, big data, IoT, and AI across industries to gain a larger group of end-users in the market. The introduction of support infrastructure will help reduce power consumption, water consumption, and carbon dioxide emissions will aid players a larger India data center market share during the forecast period.

The major vendors in the India market are:

• IT Infrastructure Providers

o Atos

o Arista

o Broadcom

o HPE

o Cisco

o Dell Technologies

o Huawei

o IBM

o Lenovo

o NetApp

• Data Center Investors

o Bharti Airtel (NXTRA DATA)

o Bridge Data Centres

o BSNL Data Center

o Colt Data Centre Services (COLT DCS)

o CtrlS

o GPX Global Systems

o ITI Limited

o NTT Communications (Netmagic)

o Pi DATACENTERS

o Reliance Communications (Global Cloud Xchange)

o Sify Technology

o ST Telemedia Global Data Centres (STT GDC)

o Zoho

• Support Infrastructure Providers

o ABB

o Caterpillar

o Climaveneta (Mitsubishi Electric)

o Cummins

o Delta Group

o Eaton

o Legrand

o Larson & Turbo (L&T) Construction

o NetRack Enclosures

o Riello UPS

o Rittal

o Schneider Electric

o Sterling and Wilson (Shapoorji Pallonji Group)

o STULZ

o Vertiv

Key market insights include

1. The analysis of India data center market provides market size and growth rate for the forecast period 2019-2024.

2. It offers comprehensive insights into current industry trends, trend forecast, and growth drivers about the India data center market.

3. The report provides the latest analysis of market share, growth drivers, challenges, and investment opportunities.

4. It offers a complete overview of market segments and the regional outlook of India data center market.

5. The report offers a detailed overview of the vendor landscape, competitive analysis, and key market strategies to gain competitive advantage.

Jessica

Arizton Advisory & Intelligence

+1 312-235-2040

email us here

Visit us on social media:

Facebook

Twitter

Google+

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.